Need help choosing?

Speak to a QuickBooks expert to find the right product for your business

Talk to sales: 0808 304 6205

9.00am - 5.30pm Monday - Friday

Get product support

Contact support Visit support pageJoin over 6.5 million subscribers worldwide

Our range of simple, smart accounting software solutions can help you take your business to the next level. Once you've chosen your plan, there's no hidden fees or charges.

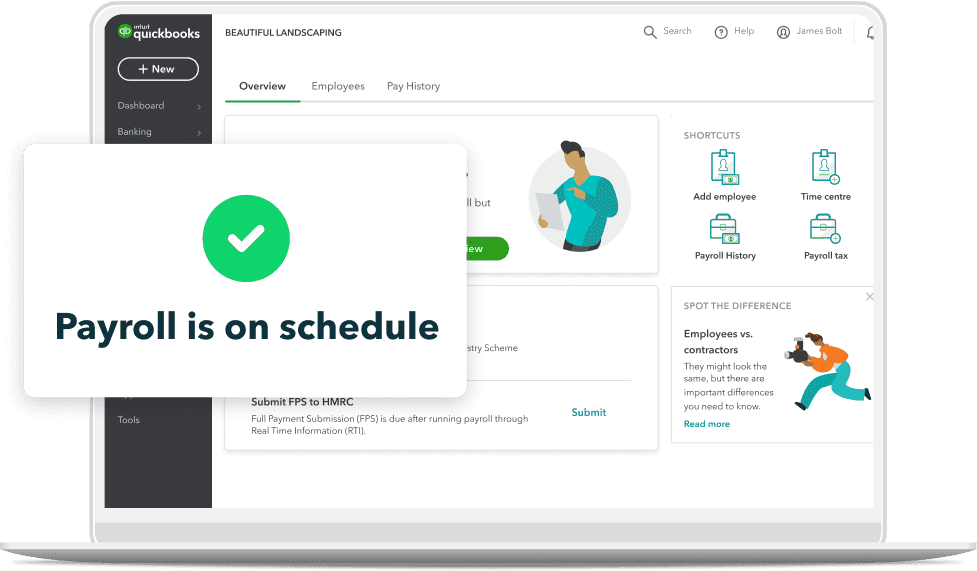

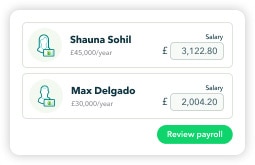

Payroll management for every size of business

For small to medium sizes businesses looking to run payroll for employees.

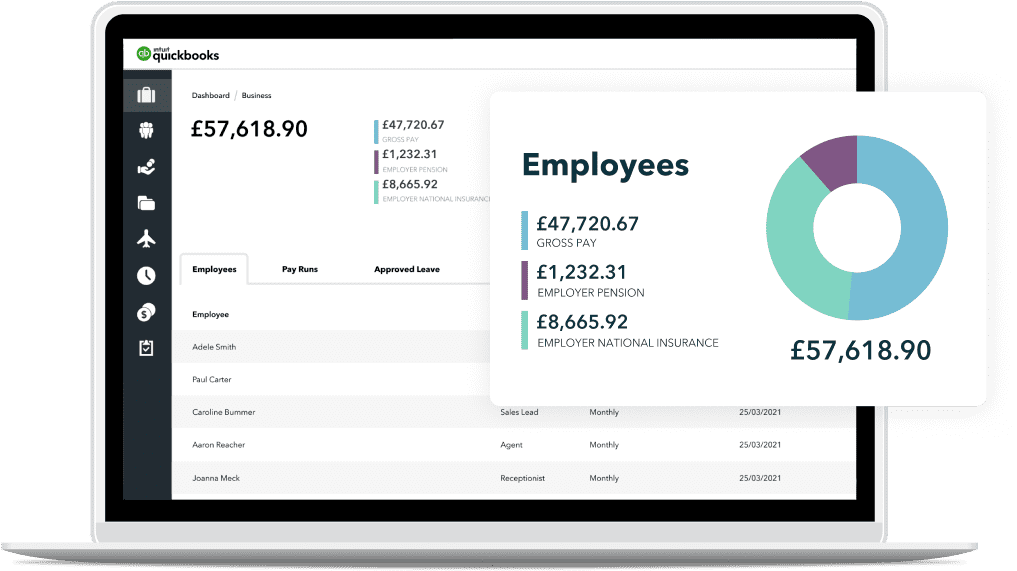

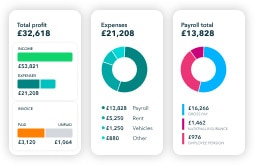

One place to manage your business

See how your business is performing day to day, with payroll that automatically syncs with your accounts.

Helps with compliance, accuracy and peace of mind

Feel assured you're paying your employees correctly – we're up-to-date with all of HMRC's changes.

No-nonsense payroll that saves you time

Make adjustments to pay runs from anywhere using our cloud-based software. Automate pension submissions and pay runs.

Benefits of QuickBooks payroll software

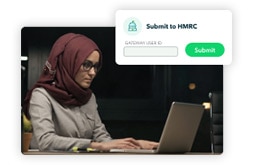

HMRC submissions

QuickBooks is HMRC-recognised with direct submissions to HMRC and automatic tax code updates.

Statutory payments

Helps you stay compliant with sick pay, maternity, paternity, adoption and parental bereavement leave.

Integration with your accounts

Automatically integrates with QuickBooks accounting so you have the complete picture of your business.

CIS

Automatically calculate contractor or subcontractor deductions and file your Construction Industry Scheme taxes directly to HMRC.[1]

Easy pensions

Assess and auto-enroll employees. We'll calculate contributions and can automatically submit details to Nest, Smart Pension, The People's Pension, NOW and Aviva.[2]

Payslips

Payslips are automatically created and can be shared with employees through a self-serve employee portal, by email or by printing them.

[1] Automatic CIS deductions feature is only applicable for Advanced Payroll

[2] Automatic submission is available only with the following providers: Core Payroll (NEST). Advanced Payroll (NEST, The People's Pension, Smart Pensions, Aviva, NOW)

The best payroll solutions for your business

We offer two solutions to help you manage payroll in a way that's right for your business.

Choose your QuickBooks Online and Payroll plan

Before and after QuickBooks Payroll

We’ve taken a snapshot of a small business before and after QuickBooks Payroll. It shows how QuickBooks means less time staring at timesheets and more time to concentrate on what you do best.

Switch to QuickBooks payroll today

Currently using another payroll provider? From switch over to setup – we're here to help every step of the way.

Our award-winning UK-based experts are here 7 days a week with free phone support, live chat or screen sharing. You'll always talk to a real person.

Customer success stories

Customer success stories

FLYTE Creative Media

Product tour

With QuickBooks Payroll you're in complete control. Manage your payroll in the same place you manage your accounts, from anywhere at any time. It'll save you hours of admin time while making sure you stay compliant. Our product tour will show you how.

Learn more about payroll

It pays to keep informed. Check out our blogs to discover everything you need to be a real team payer.

Get up and running with free support

Check out our short video tutorials and jargon-free guides, or contact our award-winning team of experts. Live chat, screen sharing and phone support are available free of charge.

New to QuickBooks? Once you've signed up, book a free 45 minute onboarding session with one of our experts. They'll walk you through key features and answer your questions - your welcome email has all the details.

Frequently asked questions

Stay informed and inspired

Subscribe to get our latest insights, promotions, and product releases straight to your inbox.